Member of Hawai'i Restaurant Association

CUSTOM JAVASCRIPT / HTML

CUSTOM JAVASCRIPT / HTML

More COVID

relief Funds

are available from the Government.

- Were you affected by COVID-19?

- Do you have W2 employees?

- Did you apply for your PPP?

- Did you apply for ERC?

You were forced to close and limit your business and you were given 2 choices: PPP or ERC ?

Now you can have… BOTH!

You were forced to close and limit your business and you were given 2 choices:

PPP or ERC?

Now you can have… BOTH!

CONTACT US:

+1 (808) 460-4372 - Hawaii

+1 (670) 785-3258 - Guam/CNMI

+1 (684) 258-1479 - American Samoa

info@gotERC.com

CONTACT US:

+1 (808) 460-4372 - Hawaii

+1 (670) 785-3258 - Guam/CNMI

+1 (684) 258-1479 -American Samoa

info@gotERC.com

Recent IRS Warnings Regarding ERC Processors

The ERC Program is not a loan, no repayment and forgiveness required.

(get your money while funding lasts)

If your CPA can do it, they would have done it. ERC consultants will be doing all the preparatory work and negotiating all the maximum qualifying benefits for your business.

We are a team of experts who specialize in determining if you are eligible for the Employee Retention Tax Credit through a simple process that takes only a few minutes of your time!

Why Should You Claim Your ERC?

As a small business owner who has been affected by the pandemic, you may be eligible for a COVID-19 refundable tax credit known as the Employee Retention Tax Credit (ERC).

Funded by the CARES Act

Originally crafted to encourage employers to keep employees on the payroll as they deal with the unprecedented effects of COVID-19.

No Restrictions-No Repayment

No repayment needed.

This is not a loan.

Originally crafted to encourage employers to keep employees on the payroll as they deal with the unprecedented effects of COVID-19.

Why Choose Our Team for Your ERC Refund?

We are a team of experts who specialize in processing ERC claims for business owners. Most general CPAs and accounting firms do not have the time or expertise to provide this service to their clients due to the complexity and knowledge required to process ERC returns.

- 100% assured to maximize credits for local and small to medium-sized businesses.

- Free analysis- There is no cost or obligation to be pre-qualified

- We would love to meet you in person.

ERC Tax Experts

We are ERC specialists.

Risk Free

Know if you qualify for the ERC claim at no cost.

Fast

Quick turn-around process. Submit documents for a prompt reply.

News Article from 93KHJ / talanei.com

News Article from Samoa News

ERC High Success Industries

Bars, restaurants; bakeries, etc.;

Salons, spas, etc.;

Retail storefronts (any industry)

Any business that provides instructions/classes (dance classes, karate, swimming, etc.)

Banquet halls and event centers;

Hotels and motels;

Dental offices and other medical offices w/ elective surgeries/operations

Veterinary clinics;

ERC Surprise Areas that Can Qualify

Marijuana businesses (it is a payroll tax not subject to the IRC 280(e) restrictions

Vending businesses (vending machines were all in places with capacity restrictions, often qualifying the owners for ERC)

Law firms (courts and other government agencies were shut down, preventing attorneys from being able to collect fees from court filings)null

Though there are many high success industries, remember that any company that paid W-2 wages and meets one of the two tests (or that started their operations during the pandemic) can meet the tests even if their gross receipts improved due to them adapting to the pandemic.

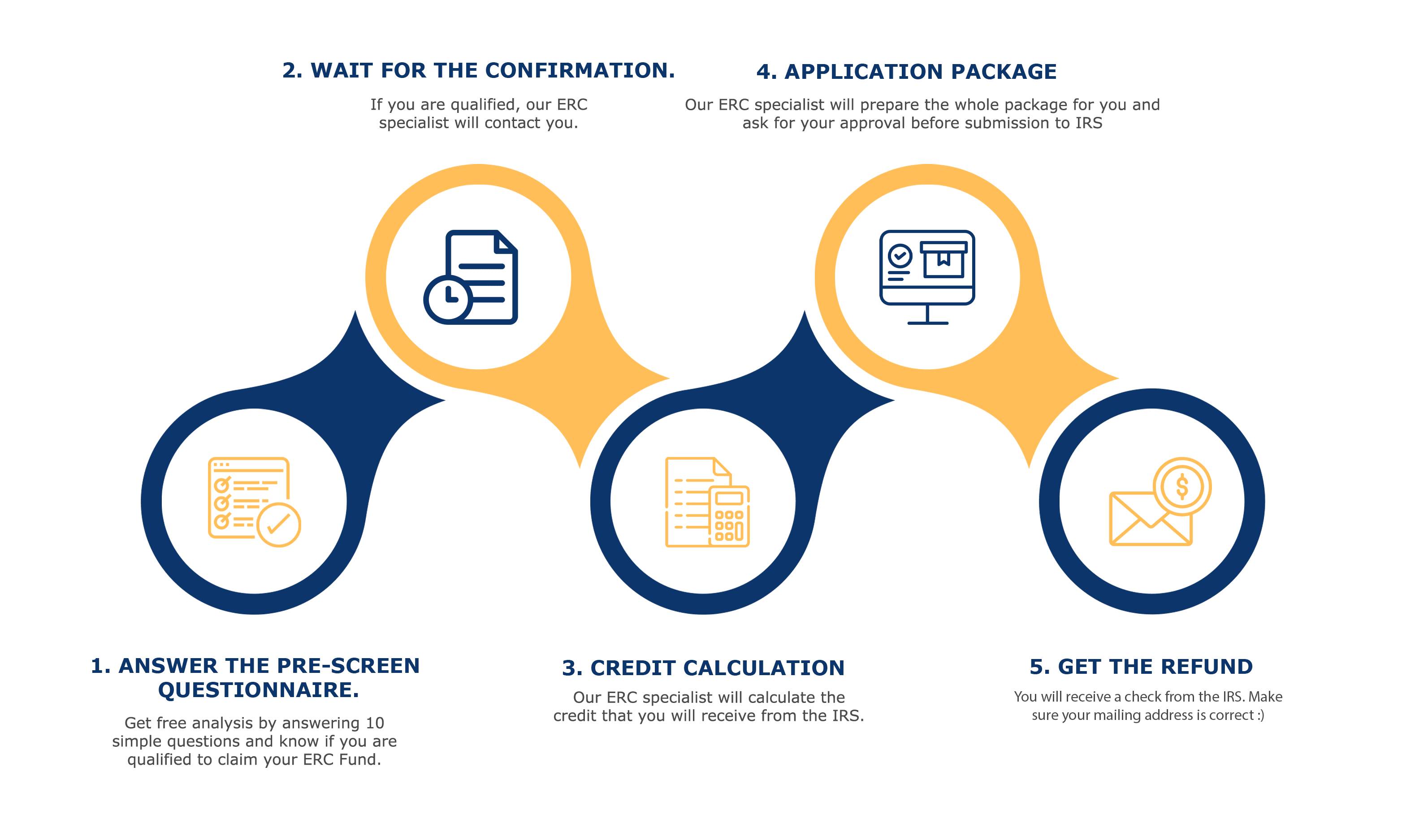

Here’s Our Streamlined Process To Make Things Easy For You

1. Answer the Pre-Screen Questionnaire.

Get free analysis by answering 10 simple questions and know if you are qualified to claim your ERTC Fund.

2. Wait for the confirmation.

If you are qualified, our ERC specialist will contact you.

3. Credit Calculation

Our ERC specialist will calculate the credit that you will receive from the IRS.

4. Application Package

Our ERC specialist will prepare the whole package for you and ask for your approval before submission to IRS

5. Get the Refund

You will receive a check from the IRS. Make sure your mailing address is correct :)

FAQ's

Most frequent questions and answers

WHAT IS THE EMPLOYEE RETENTION CREDIT (ERC) AND HOW IS IT DIFFERENT FROM THE PAYROLL PROTECTION PROGRAM (PPP)?

HOW COME MY CPA DOESN’T KNOW ABOUT THIS ?

SHOULD MY PAYROLL SERVICE PROVIDER BE ON TOP OF THIS?

MY BOOKKEEPER HAS ALL MY INFO . . . CAN THEY HANDLE MY ERC CLAIMS?

Your Bookkeeper should have access to all of the information required to calculate your legal ERC claim accurately. They will have access to your financial reports, payroll records, and PPP loan forgiveness documents.

The Million Dollar Question is. . . Do They Have Enough Time?

Do they have the time to read the text of the American Rescue Plan Act of 2021 and its referenced laws such as the CARES Act, Families First Act, Payroll & Healthcare Enhancement Act, PPP Payroll Flexibility Act, and the Consolidated Appropriations Act?

Time to read the IRS interpretations and FAQs? And cross-reference those definitions with that of PPP, which was defined separately and differently in the Small Business Administration's Bulletins and IFRs?

Do they have the time to ensure eligibility determination accuracy, maximize your computation, and create the supporting documentation required to support an IRS audit of employer taxes?

So far, we have not found a bookkeeper who can handle all of this while also handling day-to-day bookkeeping. Take them up on their offer if yours can. We'd be delighted to take another look.

MY TAX CPA HANDLE MY INCOME TAX RETURNS WILL THEY HANDLE THIS FOR ME?

Your tax accountant, whether a CPA or an EA, will most likely only prepare your Federal and State Income Tax Returns. ERC credits, on the other hand, are claimed against Employment Taxes on Form 941, and cash advances on Form 7200.

The ERC program's complexity is a beast in and of itself, and every tax accountant we've spoken with has stated that they focus on staying up to date on the ever-changing income tax code, and they can't now become experts in the ERC program as well.

If your tax accountant is comfortable determining your eligibility by quarter and year, computing your credits, and preparing contemporaneous documentation to support an IRS audit, you should delegate all of this to them.

I BELIEVE PAYROLL TAXES DEFERRED IN 2020 MUST BE RE-PAID; DOES ERC WORK IN THE SAME MANNER?

HOW DO I APPLY FOR ERC TAX CREDITS?

CAN I ALSO GET ERC IF I ALREADY GOT PPP FUNDS?

The ERC Group Video Collection

The ERC Group not only helps businesses earn important tax credits, but helps bring businesses together.

© Island Life HI

The ERC Group encourages businesses to apply for Employee Retention Credit program

© PNC Guam

© PNC Guam

The ERC Group talks about the CARES ACT Program on Tony Talks

© Island Life HI

© Island Life HI

highlights from our past events

Event Feedback

© All Rights Reserved The ERC Group 2022 | Privacy Policy

+1 (808) 460-4372 Hawaii ● +1 (670) 785-3258 Guam/CNMI ● +1 (684) 258-1479 American Samoa